pada tanggal

Car

car design

- Dapatkan link

- X

- Aplikasi Lainnya

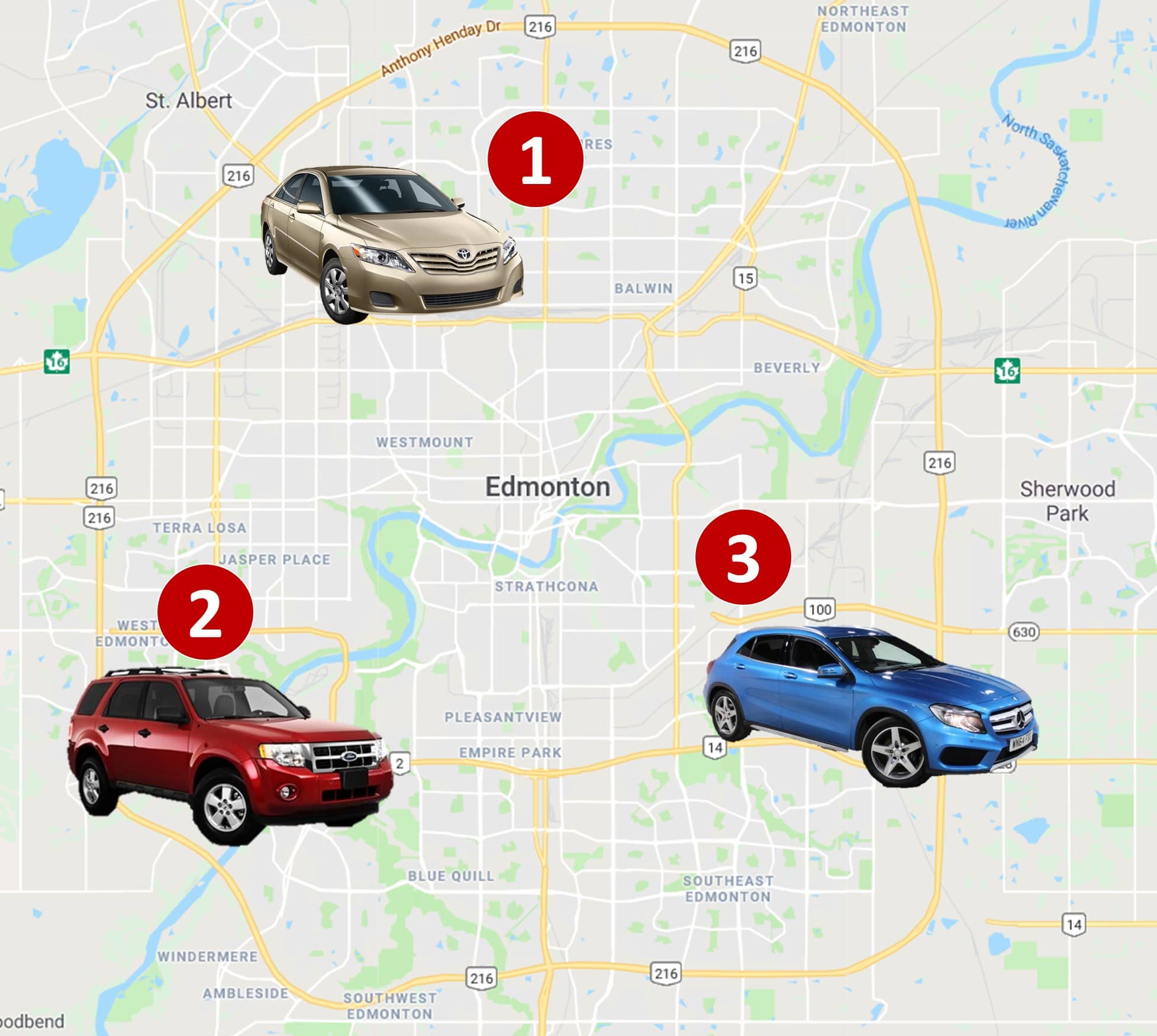

Edmonton is undoubtedly true to its nickname “Gateway to the North”. Edmonton, Canada’s fifth-largest city and home to nearly a million people, is thriving. With the growth of infrastructure and population, the number of vehicles on Edmonton’s roads is skyrocketing. All these drivers need to travel and there is no shortage of routes to get anywhere. With a network of roads, you can easily reach St. Albert from Summerside.

Whether it’s a road trip across the meadow or a daily commute via the Calgary Trail, all Edmonton drivers must have car insurance. Prices have changed in Alberta. Therefore, all Edmonton drivers need to take advantage of price comparison shopping to get the best rates.

Let’s see what’s happening with Edmonton’s car insurance.

Average car insurance premiums in Edmonton and Alberta

Alberta’s car insurance premiums averaged $ 122 / month in 2017, while Ontario’s car insurance premiums averaged about $ 161 / month in 2017.

Interestingly, Alberta’s car premiums are paid less by women than men on average, compared to $ 126 per month paid by men in 2017, which is $ 116 per month across Canada. Is almost standard.

A young Edmonton driver, under the age of 25, paid Alberta Auto Insurance about $ 187 per month in 2017. Alberta’s car insurance premiums go down as drivers get older. For example, in 2017, people aged 31-35 paid about $ 152 a month, people aged 46-50 paid about $ 122 a month, and people aged 56-60 paid about $ 100 a month.

Alberta drivers who prefer luxury cars can expect higher car insurance premiums. Drivers whose car value is between $ 40,000 and $ 80,000 paid a monthly premium of about $ 170 for 2017.

For Alberta, who chooses to buy a modest car worth $ 10,000 to $ 20,000, Alberta’s car premiums can be expected to be around $ 123 per month. This means that older models of luxury brands from compact car brands such as Kia, Mazda and Ford have the same price.

Facts you need to know about car insurance

LowerRates.ca (an online rate comparison website for car insurance, credit card rates, loans and mortgages) has released the 2018 Car Insurance Price Index Report. This is Canada’s only price index that uses its own data to track the average quarterly cost of car insurance paid by Canadians. The data is taken from the hundreds of thousands of quotes processed annually by LowestRates.ca. Alberta’s car insurance prices have risen 5.1% in 2017 since the fourth quarter of 2016, according to index reports. This means that the average Alberta driver paid more for car insurance in 2017 than in 2016.

The police have jurisdiction over who is liable for a car accident, but the insurance company decides on the car insurance claim. It is the insurer that investigates the crash and makes the decision as to who made the mistake-it ultimately determines whether the insured has to pay the deduction.

According to the Canada Insurance Authority’s (IBC) 2014 Top 10 Most Stolen Cars Statistics, cars manufactured between 1999 and 2007 were in the top 10. -Anti-theft device. In addition, the IBC states that car owners can make it too easy for car thieves to escape in their cars. About 20% of the stolen cars had keys left.

Parking violation tickets are a painful and avoidable expense for drivers, but insurance companies don’t care about the number of drivers. Therefore, it does not affect the price of car insurance. However, you will not be able to renew your driver’s license or registration if your ticket has not been paid. Suspending your driver’s license will affect your insurance premiums.

Edmonton car insurance premiums It’s changing, but the good news is that you can shop for the best prices. You don’t have to settle for one insurance agency quote.so InsurEye, Our brokers shop the market for you so you can get the best policy for your needs and budget.

Komentar

Posting Komentar